While your booking volume is an important metric to watch, it’s not the only factor that ensures your company’s financial health.

Every time a guest makes a booking on your website, it’s registered as your booking revenue. Yet this number won’t always correspond with the final profit and cash flow numbers at the end of the month because it doesn’t account for things like refunds, tour cancellations, staff costs, etc.

Your recognized revenue, on the other hand, can provide you with a clearer picture of your company’s performance.

You may look at one or the other based on your accounting methods. Accrual accounting recognizes income as soon a booking is made. Expenses are also recorded as soon as a bill arrives, regardless of when it’ll be paid. Cash basis accounting, on the other hand, recognizes income and expenses only when the transactions are final.

In this post, you’ll learn why it’s important for your company to track booking revenue as well as recognized revenue to stay on top of your finances.

- What’s recognized revenue?

- What’s booking revenue?

- What’s the difference between a booking and revenue?

- Recognized revenue vs. booking revenue

- Recognized revenue vs. deferred revenue

- The most common mistakes tours, attractions, and activity operators make tracking bookings vs. revenue

What’s recognized revenue?

Recognized revenue refers to the portion of a company’s revenue that has been accounted for within a specific reporting period, according to the principles of revenue recognition. It reflects the earnings that have been earned and are realizable. This means the company has fulfilled its obligations to deliver goods or services, and there is reasonable certainty that payment will be received.

Under generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS), revenue is recognized when several criteria are met: the existence of a contract with a customer, identification of performance obligations within the contract, determination and allocation of the transaction price to these obligations, and the satisfaction of performance obligations, whether over time or at a specific point in time. For example, in product sales, revenue is recognized when the product is delivered to the customer. For service contracts, revenue is recognized as services are performed, while for subscription services, revenue is recognized over the period the service is provided.

Recognized revenue is crucial for accurate financial reporting since it provides a true representation of a company’s earnings during a specific period. This accuracy enables stakeholders to make informed decisions based on the company’s financial health and performance.

What’s booking revenue?

Booking revenue refers to the total value of contracts or orders a company secures within a specific period, regardless of when the actual revenue is recognized. It represents the committed future revenue from deals made during the reporting period.

Unlike recognized revenue, which is recorded when the earnings are realized, booking revenue is a forward-looking metric that focuses on the value of new business won and provides insight into the company’s sales performance and future revenue potential.

Booking revenue is particularly important in industries with long sales cycles, such as enterprise software, construction, and manufacturing. For example, in the software industry, booking revenue might include the total value of a multi-year contract signed during the quarter, even though the actual revenue will be recognized over the life of the contract as the services are delivered. This metric is a forward-looking indicator, offering valuable insights into a company’s future financial health and growth prospects.

Understanding booking revenue helps you and your sales team gauge the effectiveness of your company’s customer acquisition efforts and the potential for future revenue streams. It also assists in assessing the company’s ability to generate sustainable growth. By analyzing booking revenue trends along with future performance, companies can make strategic decisions to enhance their sales process and better manage their revenue cycles.

What’s the difference between a booking and revenue?

A booking is made when a guest books one of your tours or purchases a ticket to your attraction. It’s the act of purchasing the products or services you’re offering. In this case, your guest has committed to paying you for the tour or experience you’ll provide them with.

Your monthly booking volume reflects the number of bookings you received that month. However, those bookings aren’t considered revenue until your guests actually go on your tour or visit your attraction.

Revenue, then, is actual income earned when you provide your guests with the tour or experience they purchased.

Next, we’ll look at the difference between booking revenue, recognized revenue, and deferred revenue — three financial metrics your travel company should always track.

Recognized revenue vs. booking revenue

There are a few different ways to look at your company’s revenue.

Your booking revenue is the amount of money you expect to receive for all booked tours and experiences. Based on the price of your tours or tickets, the number of bookings made will tell you how much to expect in booking revenue.

This may sound like the most important revenue figure for your company — but what happens if one of your future guests cancels their booking and requests a refund?

Then, the booking revenue recorded for that month will be different from the actual revenue collected by your company.

This is why it’s important for your tour business or attraction to also track recognized revenue. Your recognized revenue is the money that comes in after the service or experience has been delivered to your guests.

Once a guest visits your attraction or goes on your tour, you’ve fulfilled your requirement as a business owner and can now officially recognize the revenue made from those bookings.

Recognized revenue vs. deferred revenue

Deferred revenue is also known as unearned revenue. It refers to the payments your company received for products or services that have yet to be delivered.

For example, if a guest pays for a walking tour that only happens a week from today, their payment is considered deferred revenue. If the tour doesn’t happen as planned, then you may owe the money back to your customers.

You can have $1,000 in deferred revenue, but if a guest cancels and requests a refund, you won’t actually receive the full $1,000. The amount your company earns is considered recognized revenue.

Deferred revenue becomes recognized revenue after you deliver the tour or experience your guests have paid for.

The most common mistakes tours, attractions, and activity operators make tracking bookings vs. revenue

When managing tours, attractions, and activities, operators often face challenges in tracking bookings and revenue. Understanding the differences between bookings and recognized revenue is critical for understanding business performance, yet many fall into common traps that can skew their financial insights and decision-making.

In the early days of running a tour or attraction, operators might rely on basic spreadsheets or manual tracking methods. These can work initially but tend to become unwieldy as the business grows. As more bookings come in and revenue streams diversify, the complexity of tracking these metrics accurately increases. This growth phase is where many operators begin to encounter mistakes.

- Confusing bookings with revenue – Booking a tour or activity does not immediately translate to revenue. Operators often mistakenly record the full value of a booking as revenue at the time of booking, rather than when the service is actually delivered.

- Not accounting for cancellations and no-shows – Bookings that get canceled or customers who do not show up need to be properly accounted for on your profit and loss statement, which is sometimes called a P&L or income statement. Failing to do so can result in inflated revenue figures.

- Ignoring deferred revenue – For multi-day tours or season passes, the revenue should be recognized over the period the service is provided, not upfront. Many operators fail to defer revenue appropriately, leading to inaccurate financial reporting.

- Overlooking additional costs and fees – Additional charges such as service fees, booking fees, and commissions paid to third-party booking platforms should be deducted from the gross booking value to accurately reflect net revenue.

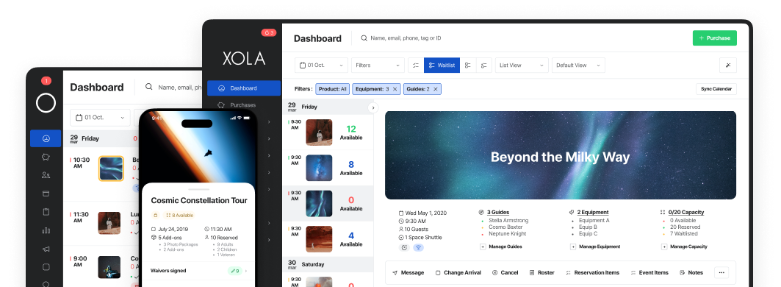

- Inadequate system integration – Relying on multiple disconnected systems for booking and revenue tracking can lead to discrepancies and data loss. That’s why it is important to sync your booking software, like Xola, with your cloud accounting software, like QuickBooks.

- Failing to update your books – Timely updates of bookings to revenue records are crucial. Delays or inconsistencies in updating these records can result in a mismatch between the actual financial status and what is recorded during a specific accounting period.

- Not distinguishing between different revenue streams – Tours, add-on activities, merchandise, and food and beverage sales are different revenue streams that need to be tracked separately to understand their individual contributions to the business.

- Lack of regular bank reconciliation – Your finance team should do regular reconciliation of booking and revenue data to ensure accuracy and help identify any discrepancies early on. Many operators neglect this step, leading to compounded errors over time.

By understanding and addressing these common mistakes, you can gain a clearer picture of your business’s balance sheet, improve financial performance, and make more informed decisions for future revenue growth.

***

In summary, your recognized revenue, also known as earned revenue, is the money that flows into your business after you deliver the service your guests have paid for. Until then, any payment that has been upfront is considered deferred revenue.