How much money is your business bringing in this month compared to last month?

Regardless of whether your tour or attraction business is brand new or been in business for 10+ years, tracking your revenue numbers is essential if you want to stay in business.

There are multiple revenue-based reports that you might want to view and monitor on a regular basis.

In this post, we’re taking a look at some of the most common revenue reports for tours and attractions, including:

- What’s a revenue report?

- What are some examples of revenue reports?

- What’s the difference between revenue and profit?

- What’s the difference between cash flow and realized earnings?

- How to pull your revenue numbers in Xola

- 4 Additional Revenue-Based Reports in Xola

What’s a revenue report?

A revenue report is a broad term that can include pretty much any report that reflects on total sales – a.k.a. top-line revenue or gross sales.

What are some examples of revenue reports?

The three most common revenue-based reports that any tour business should run and monitor on a regular basis (i.e. at least monthly) are:

- Profit and Loss Statement (a.k.a P&L Statement or Income Statement)

- Balance Sheet

- Cash Flow Statement

A P&L Statement is a way to gauge how profitable your business is at any given time. It categorizes your revenue and expenses.

If you use cloud accounting software, such as Quickbooks or Xero, the software will automatically generate a P&L statement for you.

Another report to look at is your Balance Sheet. This financial report is essential for any business owner, as it is a way to see the 50-foot view of the business. This allows you to monitor your assets (i.e. what you own) and liabilities (i.e. what you owe).

A third report is your cash flow statement. The cash flow statement is a way to see your cash inflows (i.e. money coming in) and cash flow outflows (i.e. money going out).

Note: We’ll explain a little later in this article why your cash flow statement is particularly important for tours and attractions.

What’s the difference between revenue and profit?

One of the biggest mistakes that newer entrepreneurs in any industry – including tours and attractions – make is prioritizing top-line revenue instead of profit. And, in some cases, they may even confuse the two.

Revenue is your gross sales.

Profit, on the other hand, is revenue minus your operating expenses.

For example, you can have a record-breaking sales year but still, be unprofitable if your operating expenses exceed total sales coming in.

What’s the difference between cash flow and realized earnings?

Earlier in this post, we mentioned it is a good idea to monitor your cash flow statement on a weekly or monthly basis.

For tours and attractions, it is a good idea to take this a step further and track both cash flow and realized earnings.

Cash flow is the money that is coming in and out of business based on the day the booking was made.

Realized earnings happen once the tour/experience is complete.

With the exception of maybe walk-up sales, there is going to be a lag in between cash flow and realized earnings.

This is important to keep in mind, especially when it comes to things such as refunds or chargebacks.

How to pull your revenue numbers in Xola

Within Xola, it is easy to see how much revenue you’re bringing in, the most popular listings, what marketing campaigns are leading to the most bookings, and more.

Pro Tip: If you are a Xola customer, simply navigate to Report → Analytics. Then, you can filter by either Cash Flow or Recognized Earnings as well as specific listings, among other things.

4 Additional Revenue-Based Reports in Xola

In addition, we’re including some additional revenue-based reports that you might want to monitor.

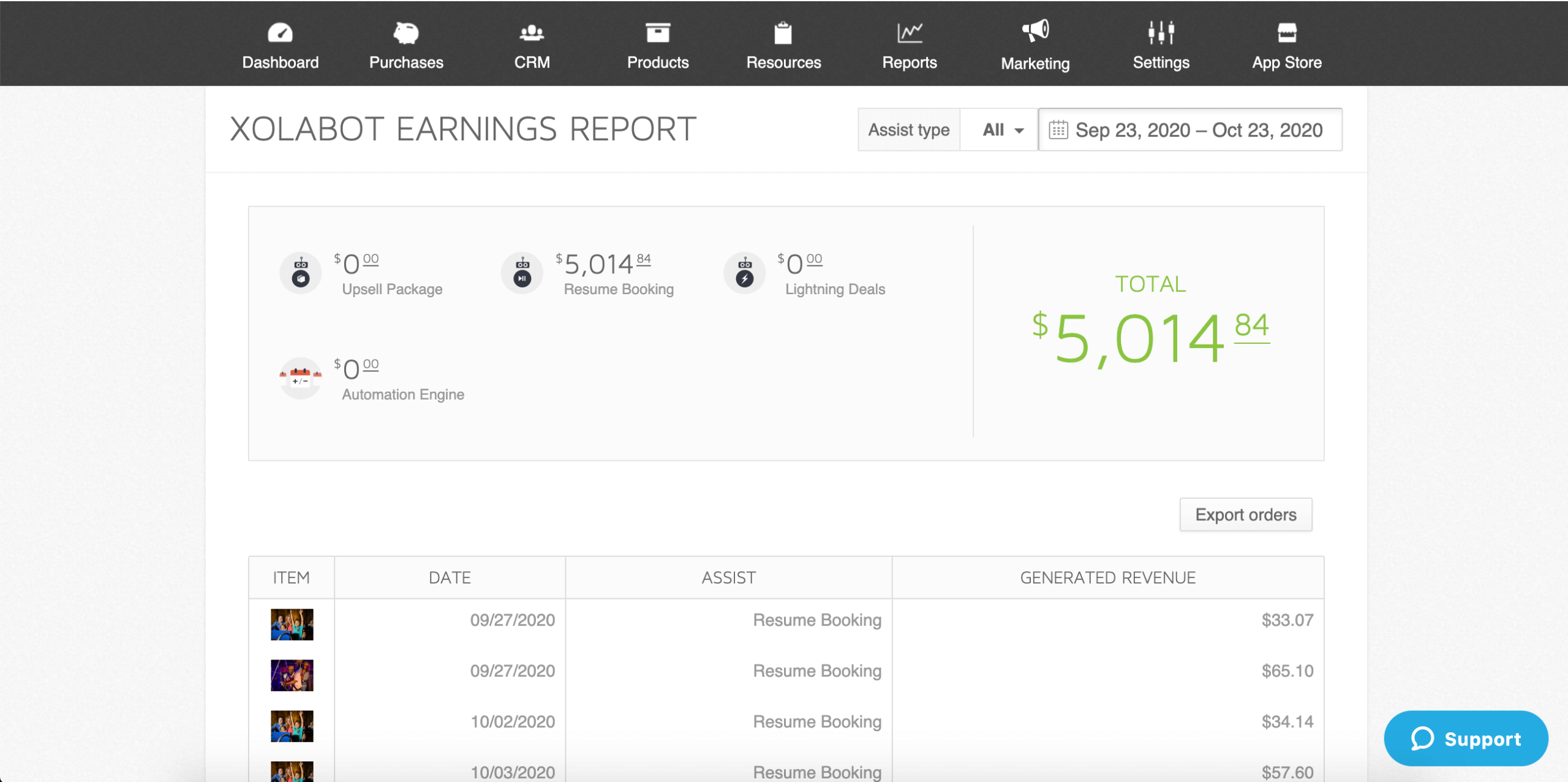

1. Earnings Report

An earning report is basically like your daily transaction report. It is a log of all of your sales plus processing fees – like credit card fees.

Pro Tip: You can also run a separate earnings report specifically for XolaBot, which shows how much money you made from Xola’s automated marketing and growth features. Learn more here.

2. Customers Report

This one is fairly self-explanatory. This is a report you can pull to see how many guests booked in a given time period.

3. Payouts Report

A payouts report is particularly useful for business owners and accountants. It is an itemized record of each deposit you have received from Xola to your bank account. One specific use case for this report is to reconcile your bank account at the end of the month.

4. Gifts & Store Credit Report

This report is particularly useful to run around the busy holiday shopping season, as you can see how many people bought gift cards as well as redeemed store credit or gift cards.

In sum, these are a handful of revenue-based reports that all tour and attraction businesses should be monitoring on a regular basis. These reports can help you make informed data-driven decisions to fuel growth.